| Executive Summary |

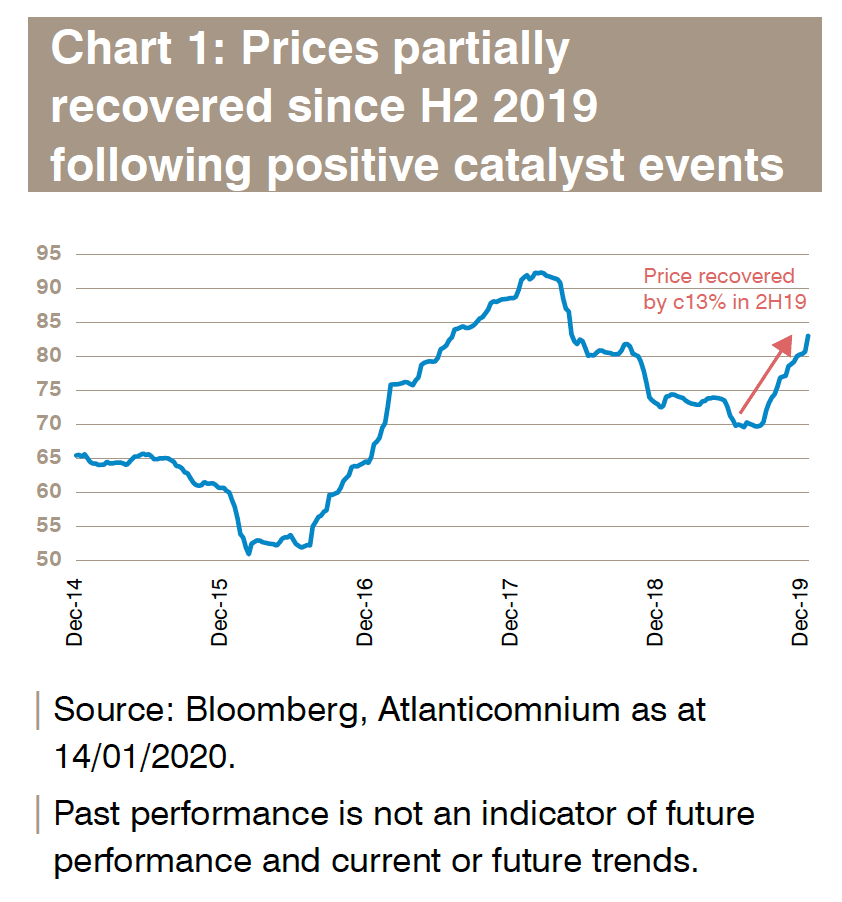

| Prices of Discounted Perpetual FRNs (Floating Rate Notes) have recovered since H2 2019, fueled by several positive catalyst events and there is scope for further price appreciation, in our view |

| Upside potential for bondholders from both a re-pricing to call and liability management |

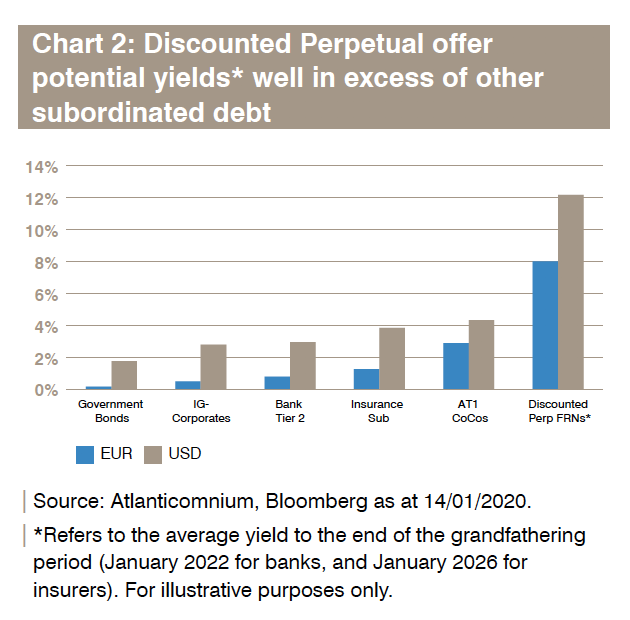

| Valuations compare extremely well compared to other subordinated financials debt, with yields of up to 8% in EUR and 12% in USD |

| Attractive asset class to mitigate interest rate risk as well as extension risk in a diversified portfolio |

Price recovery following an eventful second half of 2019

Since the publication of our piece on Discounted Perpetual FRNs* last year, a number of positive events have led to a significant price recovery in the asset class. Prices have surged by around 13% in the second half of the year, following a very challenging 2018.

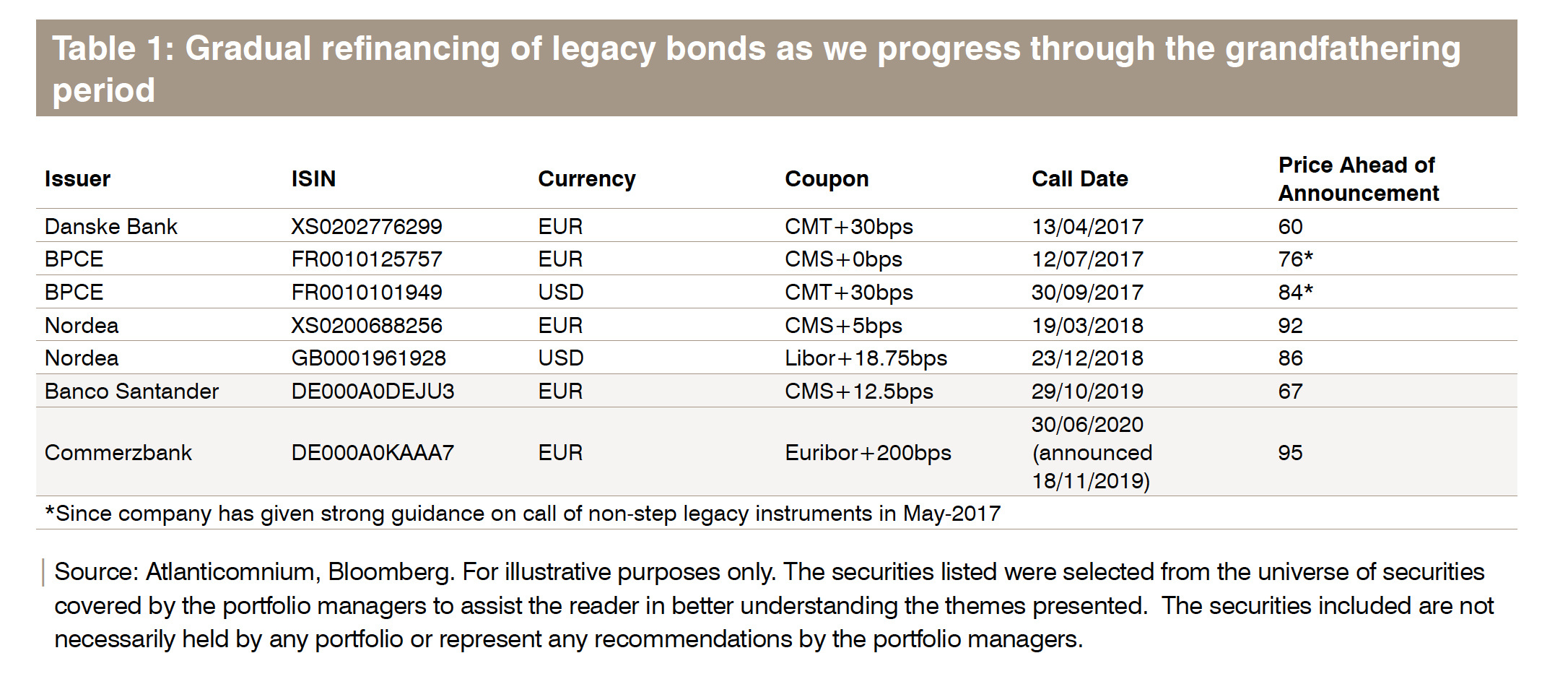

Renewed interest in the asset class from investors has been primarily driven by three liability management exercises that occurred in late 2019. Banco Santander called a EUR-denominated perpetual FRN (coupon of 10-year swap rate +0.125%), previously trading at a hefty discount to par – around 67%. Similarly, Commerzbank announced the call of a perpetual FRN (coupon of Euribor +200 bps), also trading below par. In both cases, issuers taking out bonds led to significant upside for bondholders, due to deep discounts. Although these events acted as a catalyst for the rest of the asset class (bringing back investor interest after the sell-off in 2018) – this is not a “new” phenomenon but rather a continuation of the gradual replacement of old-style inefficient bonds with new-style instruments such as (ie AT1 Contingent Convertibles (CoCos), Restricted Tier 1s (RT1s) and Tier 2 securities. Examples of Discounted Perpetual FRNs called in the past three years are illustrated in Table 1 – with bonds trading at a significant discount ahead of the call announcement.

Away from par calls, Ageas, the largest Belgian insurer, announced a tender of a legacy perpetual FRN (paying Euribor +135 bps) at 59% – a circa 10% premium to previous market prices. Beyond the price upside on the tender, this was a particularly positive event for the asset class. This instrument was a fully perpetual structure, without any ability for Ageas to call or repurchase bonds according to the prospectus. The tender needed to be combined with a consent solicitation to amend the terms and conditions to allow for repurchases. Therefore, as the tender passed – the dynamics of the bond fully changed, from a fully perpetual instrument without redemption features to one that can be repurchased by management. Moreover, by launching a tender, management put a “floor” on the price (reducing downside risk) and revealed their willingness to take-out this inefficient instrument (loses eligibility as capital in December-end 2025). As the risk-reward dynamics of the instrument improved, prices rallied after the tender to around 67% – more than 25% above pre-tender levels.

All three events have acted as powerful catalysts for a strong re-pricing of the asset class. This is on the back of a challenging 2018 where prices were under pressure due to extension risk concerns and the asset class re-priced to perpetuity. As these instruments are increasingly inefficient as capital, becoming ineligible in December-end 2021 for banks and December-end 2025 for insurers – it is difficult to argue that these should be priced to perpetuity. The positive price action has only undone some of the extension risk overshooting in 2018 – rather than a meaningful re-pricing to call to reflect the high take-out potential, in our view. Furthermore, as we progress through the grandfathering period, prices should mechanically adjust upwards to reflect a closer take-out date and higher probability of redemption.

Cheap valuations with free optionality on a take-out

Liability management action has been helpful in triggering the meaningful price recovery since H2 2019. While price action has been strong and the asset class has re-priced, the gap to a full re-pricing to call remains very wide. As discussed previously, the key catalyst for the asset class remains regulation where issuers are incentivised to redeem old-style instruments becoming increasingly inefficient as regulatory capital. In our view, this considerably reduces extension risk on the asset class and there is instead upside risk of early redemption as seen in the previous examples. In our view, there is a strong rationale for these instruments to be priced with a high probability of call.

Comparing the yields to call (using the end of the grandfathering period as redemption date) on discounted perpetual FRNs to the rest of the subordinated debt market reflects the highly attractive valuations and scope for further re-pricing to call. At circa 8% yield in EUR (using EUR-denominated Constant Maturity Swap (CMS) bonds) and circa 12% in USD (using USD-denominated Discounted Perpetual bonds) – valuations are well in excess of other subordinated financials debt. Although Discounted Perpetual FRNs share some similar features with AT1 CoCos (junior subordinated perpetuals), coupon risk and write-down risk are significantly lower. Indeed, coupons are either cumulative or non-cumulative but are not subject to automatic restrictions in case of a maximum distributable amount (MDA) buffer breach. Secondly, there is no explicit write-down or equity conversion trigger. Therefore, valuations to call should be much closer to Tier 2 than AT1 CoCos in our view. Should all bonds re-price to similar yields than on Tier 2s – the average price of the asset class should be above 95%. There will always be a discount due to the perpetual nature and low coupon rates, however given current average prices of circa 83% – upside potential purely based on re-pricing remains elevated.

Going into 2020, we expect issuers to remain active in “future-proofing” their capital structure, taking out an increasing number of legacy bonds in the process. For banks in particular, as we are now less than two years away from the end of the grandfathering period – the incentive to optimise the capital structure is only growing. Combined with mounting pressure from regulators towards running clean capital structures (ie only with fully eligible new-style instruments), there is a strong rationale for issuers to redeem old-style bonds. As these are progressively redeemed, price appreciation for bondholders will remain strong.

Finally, on top of the strong upside potential given a re-pricing to call or take-out stories, Discounted Perpetual FRN’s features make them highly attractive to hold in a diversified portfolio. The floating rate coupon structure makes the asset class positively geared to higher interest rates (coupons adjust higher), helpful to mitigate interest rate risk in a fixed income portfolio. In an ultra-low interest rate context, we believe this is highly desirable should there be an unexpected rise in interest rates, which would negatively impact traditional fixed-rate bonds. Secondly, given deeply discounted prices and the loss of eligibility as capital post the end of the grandfathering period, there is very limited extension risk on the asset class. Arguably there is upside risk of early redemption, compared to extension risk that exists in other subordinated debt asset classes, such as AT1 CoCos. Again, in a portfolio of subordinated debt instruments, mitigating the extension risk of new-style instruments is an attractive feature.

For more information, please visit GAM.com

Important legal information:

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator for the current or future development. Allocations and holdings are subject to change. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice.