Marketing material for professional/institutional/accredited investors only –

Market dislocations remain despite strong price recovery

- The dispersion of recovery in subordinated financials has been elevated, and price dislocations create attractive opportunities for investor

- We see legacy bonds as one of the most attractive segments of the subordinated financials asset class

Improving sentiment has led to significant price recovery

After a challenging start to 2020we have seen prices of subordinated financials bonds recover, led by improving sentiment. Coordinated action from central banks, governments and regulators, as well as a gradual easing of lockdown measures with positive economic implications, have supported the price recovery in credit markets.

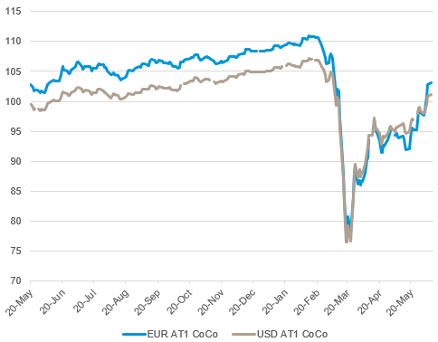

AT1 CoCos have strongly benefitted from the price recovery, with EUR and USD AT1 CoCos up in excess of 30% since lows in mid-March. Prices have now recovered 75-80% following the sell off and total returns for the year are only marginally negative for the asset class.

Chart 1: EUR and USD AT1 CoCos prices have now recovered 75-80% following the sell off

* The full legal name of the funds are GAM Star Fund plc. – GAM Star Credit Opportunities (USD), GAM Star Fund plc. – GAM Star Credit Opportunities (GBP) and GAM Star Fund plc. – GAM Star Credit Opportunities (EUR).

This is further evidenced by a significant re-pricing to call, with65% of the market now priced to maturity compared to 100% at the peak of the sell off in March. The market has benefitted positively from the re-pricing to call which has aided the recovery. With 65% of the market still priced to maturity (or to non-call), and what we regard as compelling valuations on AT1 CoCos (spreads around 500 bps on average), we remain positive on the asset class. Nevertheless, the dispersion of recovery in subordinated financials has been elevated, and price dislocations create attractive opportunities for investors.

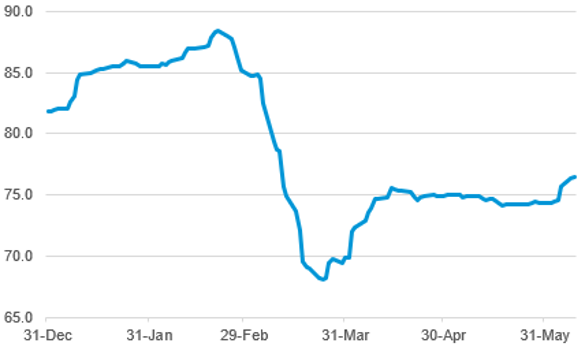

Chart 2: Percentage of AT1 CoCos priced to maturity has declined with the recovery

Source: Bloomberg, Atlanticomnium, data as at 5 June 2020.

Legacy bonds have lagged AT1 CoCos

One area that has meaningfully lagged the recovery seen in AT1 CoCos is legacy bonds – old-style capital securities issued by banks and insurance companies pre-Basel III and pre-Solvency II. As a reminder, these are grandfathered under the current regulatory regime until December 2021 for banks and December 2025 for insurers at which point they will cease to count as capital and therefore need to be taken-out by issuers.

Illustrating the performance of legacy bonds is less straightforward, as each bond has its own specific terms and conditions and characteristics (as set out in the prospectus) – however using undated perpetual floating rate notes (FRNs) as a proxy does provide an indication. Looking at Chart 3, while prices fell around 23% in the sell off, recovery has been more timid with only around 40% of price recovery, and total returns lag AT1 CoCos year-to-date.

Why are legacy bonds lagging the recovery? Several different factors explain the move. First, the majority of these bonds trade to maturity and we have not seen the same re-pricing to call compared toAT1 CoCos. This reflects the market dislocation as legacy bonds carry significantly less extension risk, with the risk of these left outstanding post the end of the grandfathering period limited. Second, marginal buyers have been mainly focused on new-style instruments such as AT1 CoCos to add beta during the recovery. These have become the bellwether for subordinated financials as a homogenous asset class and are well understood by investors. Each legacy bond has its investment case and an in-depth analysis of the bond’s prospectus is warranted to understand potential risk and reward, which has contributed to the delay in price recovery due to the expertise required.

Chart 3: Legacy bond price recovery has lagged

Source: Bloomberg, Atlanticomnium, data as at 9 June 2020.

Legacy bonds, a significant opportunity in a dislocated asset class

Given the limited recovery seen in legacy bonds, valuations are extremely attractive with significant optionality in case bonds get taken-out by issuers. While each instrument has its own story, we focus on two areas in the legacy space: instruments trading at a discount with upside on a par call or tender, or instruments trading above par with special redemption features or tender potential (and without downside risk of par calls).

The first category is mainly discounted perpetual FRNs, both of banks and insurers, that trade at deeply discounted levels (currently around 75%) and therefore offer free optionality upon redemption or in case of tender. We have seen several examples in the recent past of issuers taking-out bonds at par, for example Banco Santander redeemed an old perpetual FRN at par that was trading at 67%.

Beyond deeply discount bonds, a number of fixed-rate and fixed to floating bonds trading above par also offer significant optionality in case of redemption or tender. Most notably, a number of bonds include special redemption features (“make-whole”) where the issuer needs to pay a premium to bondholders as a compensation for the early redemption. As an example, in October 2018, Santander UK announced the redemption of their 8.963% USD legacy fixed-to-floater perpetual bonds (callable in 2030) at 150% (calculated based on a yield to call in 2030 of the prevailing US Treasury rate + 50 bps). These bonds were trading around 133% prior to the call, which represents 13% of upside for bondholders.

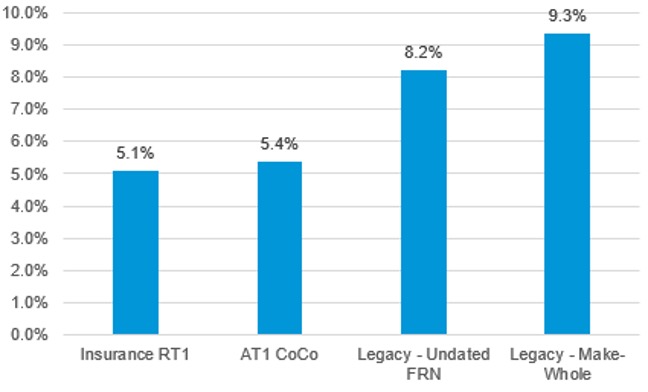

In both categories we see extremely attractive opportunities, with attractive valuations and significant optionality for bondholders. For example, taking the average yield to a take-out at the end of the grandfathering period gives an average yield of 9% on bonds with a make-whole features and 8% on discounted perpetual FRNs. To illustrate these opportunities:

- Commerzbank 8.151% 2031 (callable in 2029) in USD currently trade at 136% or 3.4% yield to maturity (260 bps spread). The issuer has the option to redeem the bonds from December 2021 at a special price called the “make-whole” price, currently equivalent to circa 150% and therefore the yield to call in January-22 is attractive at 13.7%.

- RBS Legacy Perpetual FRNs (floating coupon of Libor +232 bps) in USD currently trade well below par at 92%. RBS can redeem those at par from December 2021 at which point the bonds will no longer count as capital. This is equivalent to a 8% yield to call (or circa 800 bps of spread) – extremely attractive.

- Aegon Legacy Perpetual FRNs (floating coupon of 10-year USD Swap + 10 bps) currently trade well below par at 72%. Aegon can redeem those quarterly and the bonds will lose their eligibility as capital in December 2025. This is equivalent to a 7% yield to call (or circa 700 bps of spread) in case of par call in December 2025.

Chart 4 – Legacy bonds offer extremely attractive valuations (yield to a take-out at the end of the grandfathering period) compared to new-style Tier 1 instruments

Catalysts for a re-pricing?

The most obvious and straightforward catalyst for legacy bondholders is time. This is especially important as the end of the grandfathering period for banks (December 2021) is quickly approaching, and therefore we expect an acceleration of redemptions. For insurers this is further away in end-2025, but nevertheless we could see some opportunistic tenders or refinancing when markets to issue new-style instruments are favorable. Time is also a positive tailwind for the asset class, as issuers will need to take-out these bonds to optimise their capital structures until the end of the grandfathering period. This compares to AT1 CoCos that have extension risk as they continue to count as capital if not redeemed.

The second catalyst is the significant price recovery of AT1 CoCos and re-pricing to call. As valuations of AT1 CoCos have come in and spreads tightened significantly, interest in legacy bonds that offer significant upside is likely to pick-up. We are seeing early signs of renewed demand for the asset class, reflected in the price increase seen in early June – for example discounted perpetual FRNs rising by a few points.

Overall, we see legacy bonds as one of the most attractive segments of the subordinated financials asset class, where price recovery has lagged AT1 CoCos. Valuations are compelling with yields well above that of new-style AT1 CoCos and RT1s, and there is significant optionality for bondholders in case of take-out. As we progress through the grandfathering period, we expect issuers to accelerate the refinancing of old-style bonds into new-style instruments. In the near term, we expect a continued ramp-up in demand from investors as the asset class has lagged AT1 CoCos and remains highly dislocated.

The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Allocations and holdings are subject to change. Past performance is not an indicator of future performance and current or future trends. The gross performance does not include the effect of commissions, fees and other charges, which may have a negative effect on the net performance.

All Legal information available on the pdf enclosed.