SUBORDINATED DEBT – AN ATTRACTIVE ASSET CLASS

Executive Summary

| Since the global financial crisis (GFC) new regulations obliged banks and insurers to strengthen their balance sheets by increasing and maintaining high levels of capital |

| The financial sector is highly regulated and transparent, reflecting the solid fundamentals of the institutions concerned |

| Subordinated debt can be issued and accounted to meet regulatory capital requirements as well as issuance being cheaper than equity |

| Highly rated issuers rarely find themselves in distress and bear a low risk of default |

| By moving down the capital structure of investment grade issuers, it is possible to capture steady high income akin to high yield, without taking on more credit risk or interest rate risk |

What is subordinated debt and why is it issued?

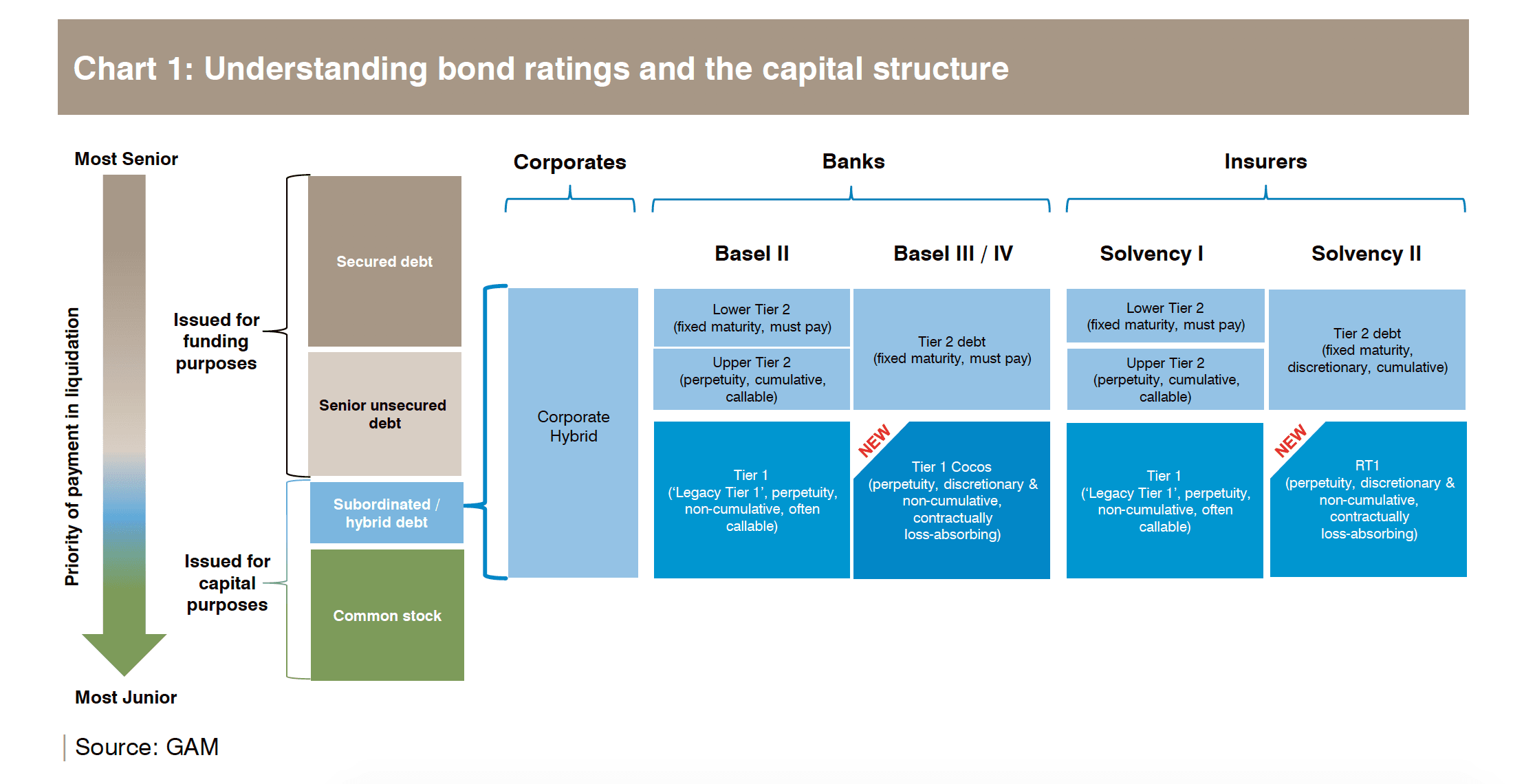

Subordinated or ‘junior’ debt covers all debt ranking below senior debt and above common equity. These bonds are not issued for funding purposes (as is usually the case for senior debt), but for capital purposes. Subordinated debt is a cheaper solution than equity capitalisation for issuers. Focusing on the financials sector, part of banks and insurers’ capital requirements can be met with subordinated debt. To illustrate the attractiveness of issuing subordinated debt for issuers, the cost of equity for European financials is estimated to be above 10%, compared to subordinated debt paying coupons of 4% or above in euros. This is indeed a cheaper solution for issuers as well as being a very attractive income opportunity for investors. Within the subordinated debt space, a variety of different bonds and structures exist. For what concerns the financial issuers the structure of subordinated debt securities is well defined and harmonised under new regulatory frameworks, namely Basel III (for banks) & Solvency 2 (for insurers) in the form of Tier 1 and Tier 2. The corporate sector, on the other hand, is free of binding rules and its securities are categorised as hybrids. Nonetheless, as corporate hybrids follow rating agency criteria, these remain a relatively homogeneous asset class. Additional Tier 1 Capital Contingent Convertibles (AT1 CoCos) are examples of subordinated debt instruments issued by banks to fulfil regulatory capital requirements. Similarly, Restricted Tier 1 (RT1) bonds are junior bonds issued by insurance companies to fulfil regulatory capital requirements (Solvency II). Corporate hybrid bonds, subordinated securities issued by the corporate sector, as for the financials, are still issued for capital purposes. However, as this sector is not subjected to a binding regulatory regime their scope is to improve the capitalisation profile (rating agencies partially count hybrids as equity when computing credit metrics) of an issuer in order to strengthen their credit profile.

From an investor perspective, the key difference between subordinated debt and senior debt arises when an issuer finds itself in a situation of distress. Subordinated bonds rank lower down the capital structure than senior bonds from the same company, therefore, having a lower priority of payment in a liquidation scenario. For this reason, moving down the capital structure, the rating agencies typically reduce the ratings of the bonds as subordinated debt bears a higher risk of loss in a default scenario. This is due to their recovery rate – the extent to which principal and accrued interest on defaulted debt can be recovered – rather than being due to higher default risk. This said, by only investing in very safe (unlikely to default) companies in the first place, the risk of senior or subordinated debt is effectiv ely very similar. By descending the capital structure of investment grade companies we currently find yields of more than 4% for subordinated debt in EUR and capture an income pick up more than 4 times higher than the senior debt from the same issuer by taking fundamentally the same risk of default.

Who are the issuers and what is the size of the market?

The universe of subordinated financial debt is growing and now has a market cap in excess of USD 1 trillion split between banks (USD 700 billion), insurances (USD 250 billion) and corporates (120 billion), according to our estimates. Historically, the raft of subordinated debt has been issued by financial institutions under the obligation to meet the requirements of the regulatory regimes. Both banks and insurers are obliged to maintain or exceed a minimum amount of capital, respectively 15% of the risk weighted assets for banks (on average) and 100% of solvency for insurers. Capital requirements must mostly be met with equity capital, with an allowance for subordinated debt. The reason for issuing such bonds is mainly because of their cheaper cost than equity and tax deductibility while qualifying for favourable regulatory treatment. As a result, the whole European banking sector is issuing subordinated debt as well as other financial institutions, such as insurers, with coupons of 4% or above in EUR. Similarly, corporate issuers, particularly those from capital intensive sectors with substantial funding needs, despite not being subject to binding regulations, have also been issuing subordinated debt in the form of corporate hybrids (current market size of circa USD 120 billion). The rationale behind this is not the same as the financial sector; the main reason is because of their favourable tax and rating agency treatment. The combination of low interest rates and attractive issuance costs act as incentives for companies to issue hybrid securities to improve their credit rating profile, lower their funding costs, diversify their financing mix, refinance maturing hybrid issues and finance recent or planned acquisitions.

Why should investors take note?

For investors unwilling to compromise on interest rate risk or credit risk, we think that subordinated debt of strong issuers is an attractive alternative especially within the heavily regulated financial sector where we can find yields of 4% or more in EUR for securities issued by highly-rated institutions. By moving down the capital structure, it is possible to capture an income akin to high yield without taking on higher default risks. An example could be UBS, an A- rated issuer, for which the senior unsecured debt is currently trading at a spread of 67 bps and its AT1 Cocos are trading at a spread of 290 bps for the same default risk. Valuations are therefore highly attractive and can be found not only among banks but within the whole financial space as well as in corporates.

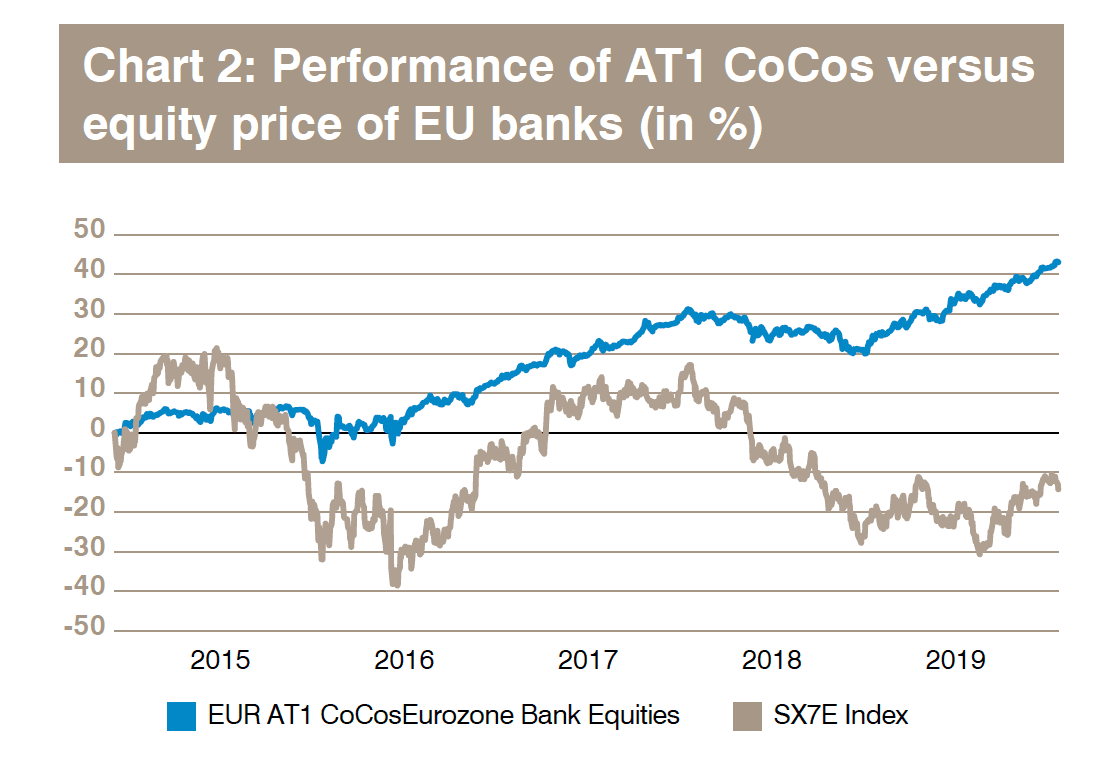

Among financials, while equity market performance has suffered, the fundamentals of the sector kept improving following the multi-year process of capital strengthening imposed by regulators since the GFC. Banks, for example, have accumulated significant amount of tangible equity since FY 2007 and capital ratios have more than doubled from 6% to almost 15% on average during this period. Overall, capital levels and hence the solvency as well as loss absorption capacity of European banks has strongly increased reflecting ever tougher regulation.

Looking at performances, since 2015, when the European Central Bank started its quantitative easing programme, the average equity price of the banks in the European Union has declined by 14%, this has been due to the impact of negative interest rates on bank profitability. On the other hand, AT1 CoCos returned 43% (Chart 2) in response to overall strengthening fundamentals driven by increasing capital ratio and de-risking in the banking sector. In addition, as the regulatory journey is ongoing, as reflected by Basel IV which will need to be implemented from 2022 up until 2027, we anticipate further capital build up, fundamentally stronger issuers, and potential for high steady income from the subordinated asset class.

Where is the downside?

Capital retention: the importance of choosing the right issuers

If a company has both subordinated debt and senior debt, in the event of bankruptcy or liquidation, the senior debt is paid back before the subordinated debt. Nevertheless, as the probability of default is the same for both senior and junior debt, the selection of the issuers is the primary key step to consider when investing in subordinated debt. Only once the risk of default of an issuer is fundamentally assessed, going down the capital structure of quality investment grade issuers (bearing a low probability of default) results in an interesting value opportunity to capture higher yields without increasing interest rate risk or credit risk.

Technical features: investing in complicated bonds

These securities have quite complicated structures for investors lacking expertise. They bear very specific features compared to senior bonds such as coupons that can be cumulative or non-cumulative, for example. The terms and conditions of the bonds are set out in the prospectus – a 200-page legal document. Specific clauses can have a significant impact on the potential upside or downside risk for investors, and therefore considerable time should be allocated to fully understanding these intricacies before investing in the asset class. Other technical drivers, for example, the extension risk for AT1 Cocos can impact market pricing. Extension risk refers to the fact that a CoCo is either called at par after the requisite number of years or the coupon is re-fixed for a further period. The risk lies within the fact that spreads widen when demand from investors lessens as they buy on the expectation the bond will be called at a specific date. Therefore, this sensitivity can impact market pricing requiring another layer of analysis.

Bond investors versus equity investors: looking at fundamentals

We are investing in bonds, not equity, and concerns are often raised about the historical volatility in financial junior debt. During the GFC, drawdowns were dramatic and reflected weak financial issuers’ fundamentals at the time (regulation was significantly looser) as well as the fact that you would get less back (potentially) for junior debt than you would for their senior counterparts. However, the multi-year process of capital strength imposed by regulators to the financial sector has been implemented to have better capitalised institutions and lower the risk of a systematic crisis, where banks would deal with a new crisis using their equity buffer (as opposed to public funds). For bondholders this is positive and given rock solid fundamentals we anticipate we may see lower volatility in a crisis scenario with more equity buffer to protect from losses.

Outlook for a young market

We view the subordinated debt market as being akin to where high yield was two decades ago. High yield is now well-understood and is a mainstream asset class which has evolved through the years. Likewise, the subordinated debt market will continue its evolution. Interestingly, the regulatory and financial advantages of subordinated bonds are now increasingly recognised by the market and the search for income is bringing the attention towards this asset class. This trend is welcomed by Atlanticomnium, being specialists of subordinated debt, and allows us to hunt for the best opportunities. We believe that going forward, the asset class should continue to gain wider acceptance and be in demand from yield-starved investors.

For more information, please visit GAM.com

Important legal information:

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect th e point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator of current or future trends.