Extension Risk – Additional Tier-1 Contingent Convertibles (AT1 CoCos)

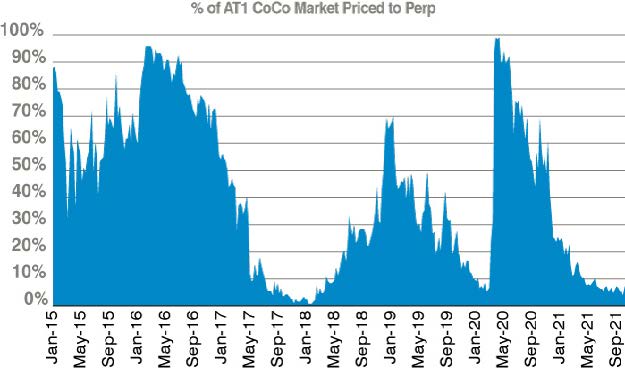

Extension risk, or the risk of price declines in AT1s due to a re-pricing to perpetuity, remains very much in focus. The market tends to be inefficient and cyclical when assessing extension risk, overshooting one way or the other when markets are strong or soft. Chart 1 illustrates the percentage of the market priced to perpetuity, which has been as high as 100% during Covid-19 and below 10% at times when markets were very risk on (early 2018, pre-Covid-19).

Chart 1: Percentage of AT1 CoCo market priced to perpetuity

Source: Bloomberg, Atlanticomnium. Data from 1 January 2015 to 30 September 2021. Past performance is no indicator of current or future trends. For illustrative purposes only.

In our view, the market is currently in a phase of ‘underpricing’ extension risk, meaning there is complacency. However, as we have seen before, extension risk is one of the major risks for bond investors. Bonds with low resets (where the coupon in case of non-call resets to a relatively low level) have significantly underperformed. Investors are willing to accept similar or only marginally higher spreads to buy bonds with significantly higher extension risk, which we view as irrational.

The good news is that this is a ripe environment for bottom-up driven investors to select bonds with the most attractive upside potential, without sacrificing on yield / spreads. For example, Rabobank’s 3.1% lower reset AT1s (coupon resets to the five-year EUR swap rate +323 bps if not called) offer only an adjusted 10 bps of spread pick-up to the higher reset 4.4% AT1s (reset of 468 bps), meaning that investors can move to a much more resilient structure without sacrificing much spread.

Extension risk has also been a good indicator of where we are in the AT1 cycle. As we are now in a state where most of the market is priced to call (<10% priced to perpetuity), and risk premiums have declined significantly (the premium to hold lower quality names is low, for example), we are more selective in the AT1 market. While attractive opportunities remain, we feel that diversification across the capital structure offers significant value. For example, Rabobank’s 6.5% perpetual Tier-1s offer a yield of 4.7% compared to 2.7% for Rabobank’s AT1s despite similar risks for both.